In today's fast-paced world, convenience is a top priority for customers. Businesses are increasingly focused on streamlining their services and offering seamless shopping experiences. From mobile apps to quick checkout options, enhancing convenience leads to greater customer satisfaction and loyalty.

With the rise of e-commerce, customers expect a hassle-free online shopping experience. Easy navigation, fast loading times, and simple return processes are essential for meeting their needs.

Offering personalized services is key to enhancing customer convenience. Tailored recommendations and flexible delivery options ensure that customers feel valued and appreciated.

Increased efficiency is crucial for businesses aiming to maximize productivity and reduce costs. By streamlining processes and leveraging technology, organizations can minimize waste and optimize resource allocation. This not only enhances operational performance but also improves overall customer satisfaction.

Efficient workflows eliminate bottlenecks and speed up project completion. By implementing automation tools, teams can focus on high-priority tasks, driving better results with less effort.

Leveraging data analytics can significantly boost efficiency. By analyzing performance metrics, businesses can identify areas for improvement and make informed decisions that enhance productivity and profitability.

Improved cash flow is vital for the financial health of any business. By effectively managing receivables and payables, companies can ensure they have sufficient liquidity to meet their operational needs. This financial stability enables investment in growth opportunities and enhances overall resilience.

Efficient invoicing processes can dramatically improve cash flow. By reducing billing errors and accelerating payment collection, businesses can maintain a steady influx of funds while strengthening customer relationships.

Implementing effective cost management strategies contributes to better cash flow. By identifying unnecessary expenses and optimizing resource allocation, businesses can enhance profitability and ensure they have the cash needed for strategic initiatives.

Enhanced customer experience is essential for businesses aiming to build long-term loyalty. By focusing on understanding customer needs and preferences, companies can create personalized interactions that resonate with their audience. Investing in customer service, user-friendly interfaces, and feedback mechanisms leads to improved satisfaction and retention.

Tailoring services and communications to individual customers significantly enhances their experience. When businesses recognize customer preferences and provide customized recommendations, they foster deeper connections and encourage repeat business.

Offering multiple support channels, such as live chat, email, and social media, enhances customer experience. This accessibility ensures that customers can quickly resolve issues and receive assistance when they need it most, resulting in higher satisfaction rates.

Data insights play a critical role in driving business decisions and strategies. By analyzing customer behavior, market trends, and operational performance, organizations can gain valuable perspectives that inform their actions. This data-driven approach not only enhances efficiency but also enables companies to anticipate needs and stay ahead of the competition.

Harnessing data insights allows businesses to transform raw data into actionable strategies. By identifying key patterns and trends, companies can make informed decisions that align with their goals and enhance overall performance.

Leveraging data insights provides a deeper understanding of customer preferences and behaviors. This knowledge empowers businesses to create targeted marketing campaigns and improve product offerings, ultimately leading to increased customer satisfaction and loyalty.

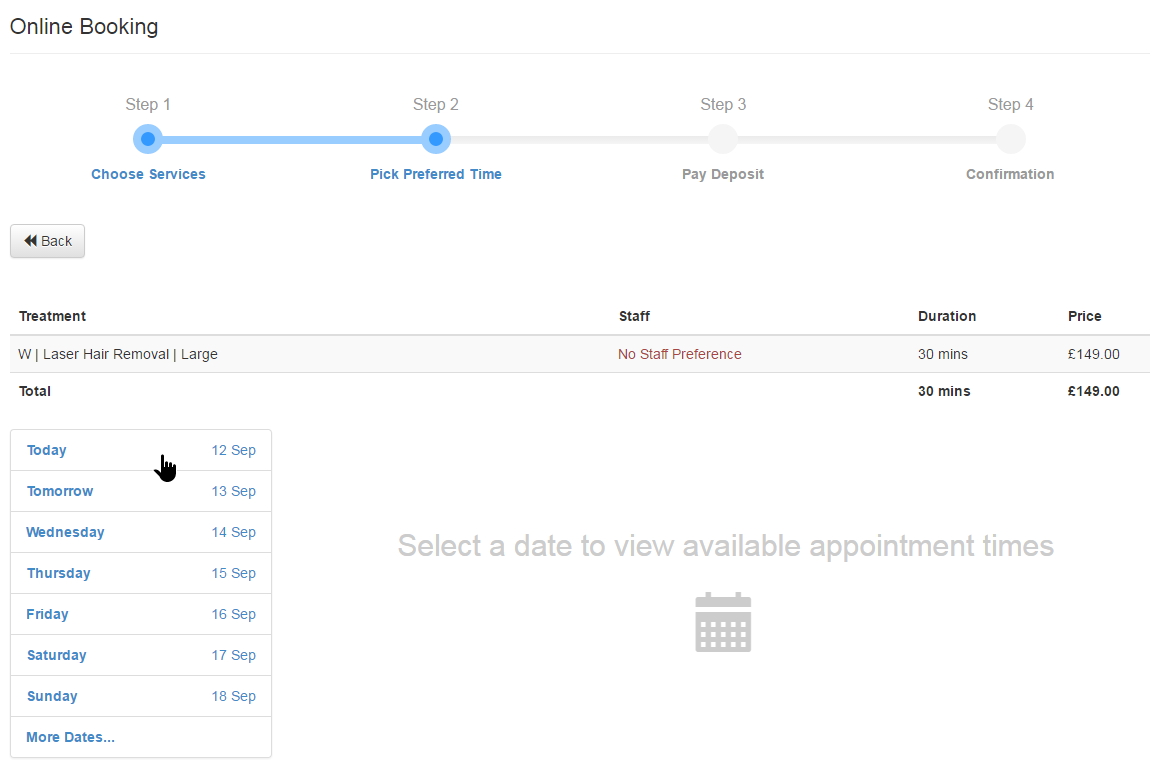

Reducing no-shows is essential for optimizing resources and maximizing revenue in any business, especially in service-oriented industries. By implementing reminders, flexible scheduling options, and clear communication, companies can significantly decrease the likelihood of customers missing appointments. This proactive approach enhances operational efficiency and customer satisfaction.

Utilizing automated reminder systems can effectively reduce no-shows. Sending timely notifications via text or email helps keep appointments top of mind for customers, ensuring they arrive as scheduled.

Offering incentives for keeping appointments is a strategic way to minimize no-shows. By providing discounts or loyalty points for attendance, businesses can encourage customers to follow through with their commitments, benefiting both parties.

Flexibility and scalability are crucial for modern businesses looking to adapt to changing market conditions. Companies that embrace these qualities can efficiently respond to customer demands and industry trends, allowing for rapid growth without sacrificing service quality. This adaptability fosters innovation and ensures long-term success.

Flexible business models enable organizations to pivot quickly in response to market fluctuations. By being open to change and adopting scalable solutions, companies can effectively seize new opportunities and navigate challenges.

Implementing cloud-based solutions enhances both flexibility and scalability. These technologies allow businesses to easily adjust their resources according to demand, ensuring they remain agile and capable of expanding operations as needed.

Secure transactions are paramount in today’s digital landscape, where cybersecurity threats are increasingly prevalent. Implementing robust encryption methods and secure payment gateways protects sensitive customer information and fosters trust. Businesses that prioritize transaction security not only safeguard their assets2 but also enhance customer confidence and loyalty.

Ensuring secure transactions is essential for building customer trust. When customers feel confident that their financial information is safe, they are more likely to engage in repeat business and recommend the service to others.

Adhering to compliance standards and regulations is critical for secure transactions. By following guidelines such as PCI DSS, businesses can ensure their payment processes meet industry requirements, mitigating risks associated with data breaches and fraud.

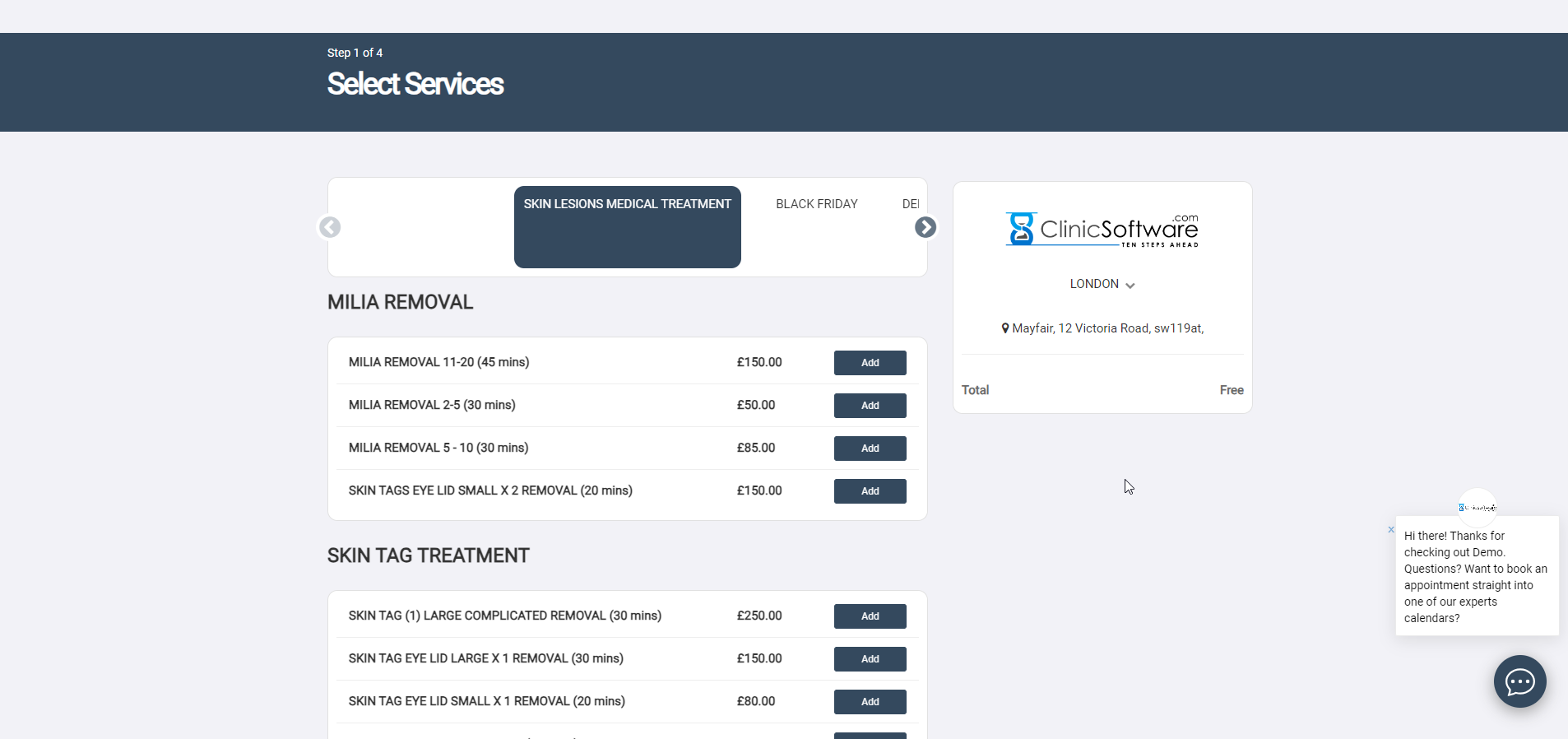

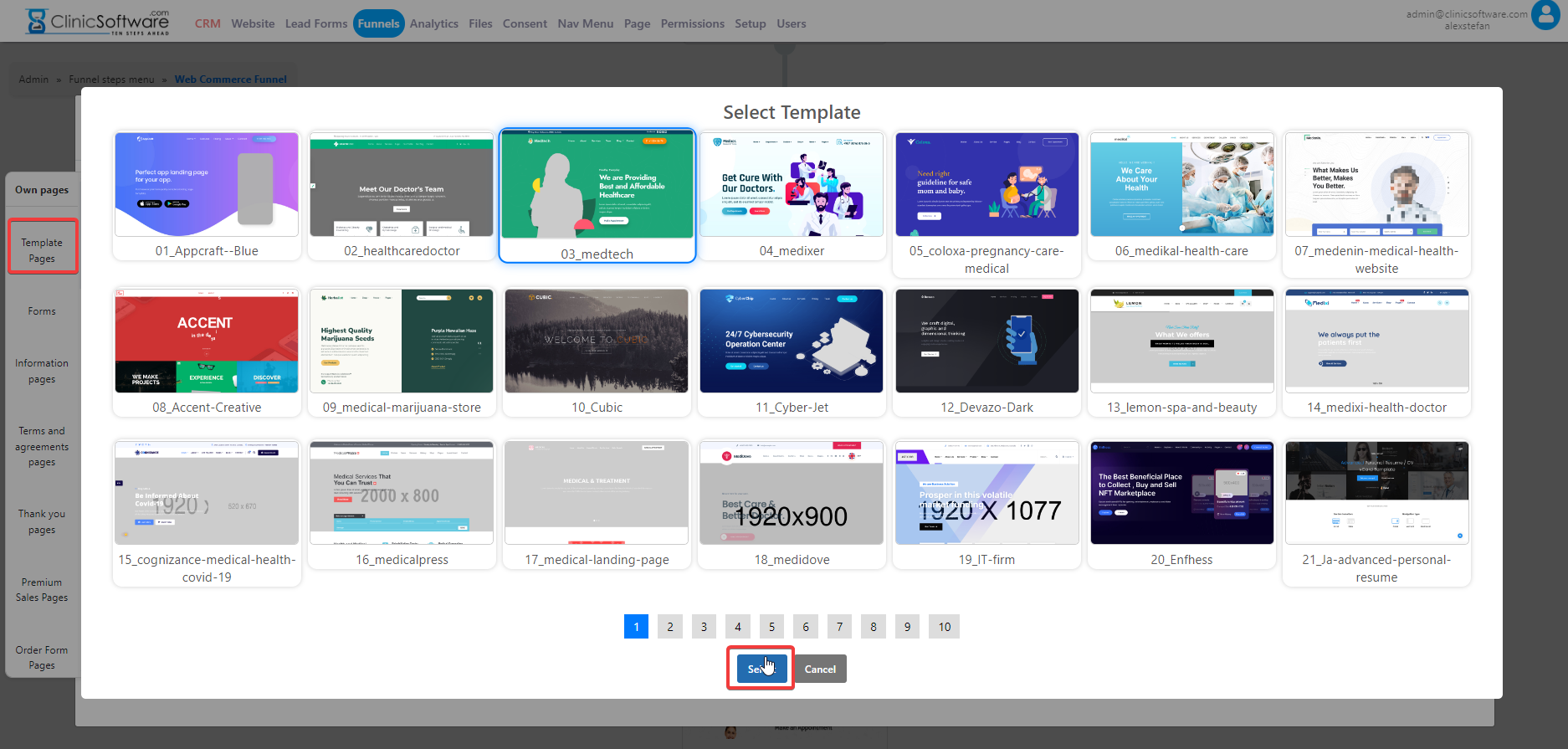

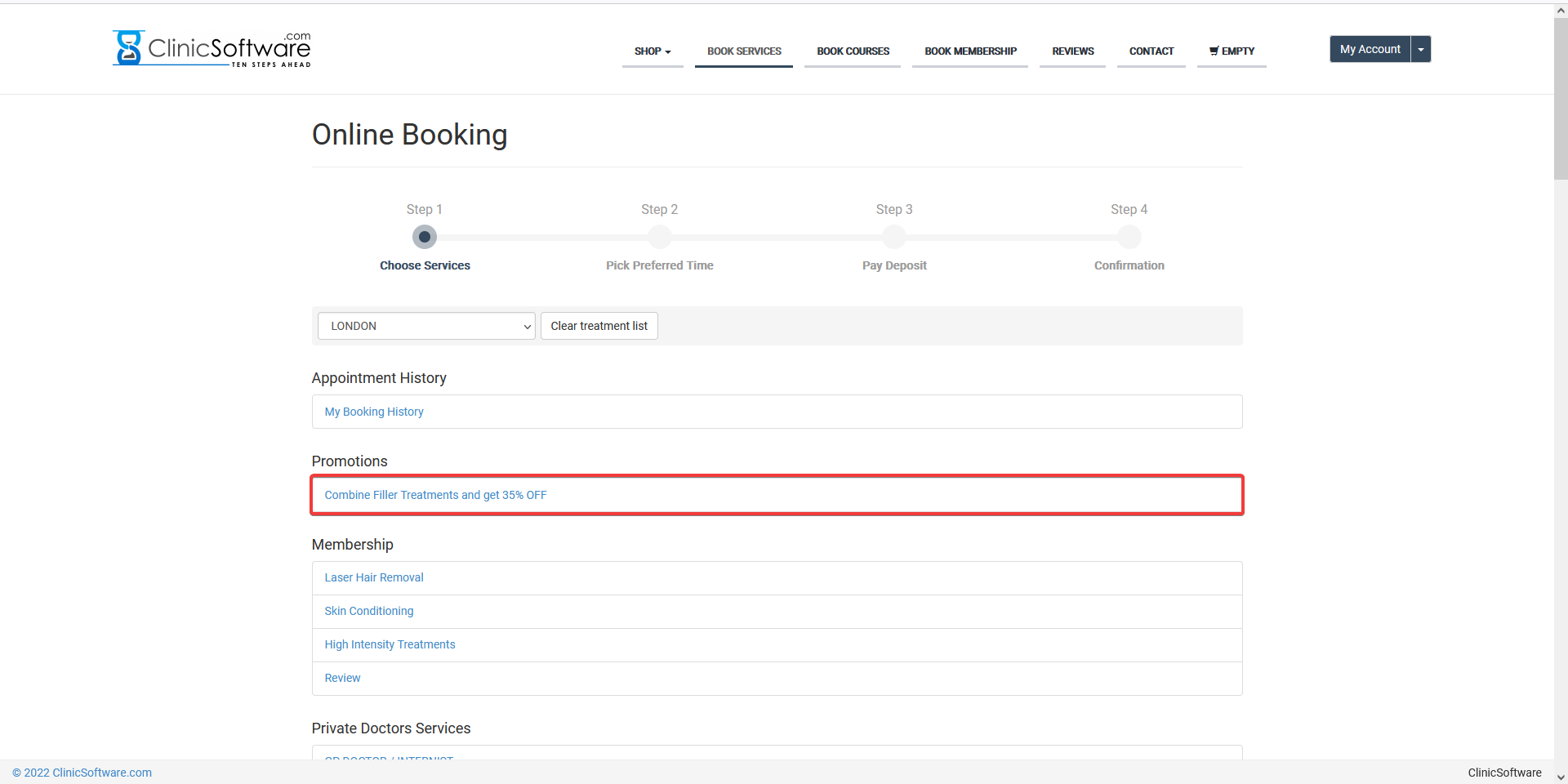

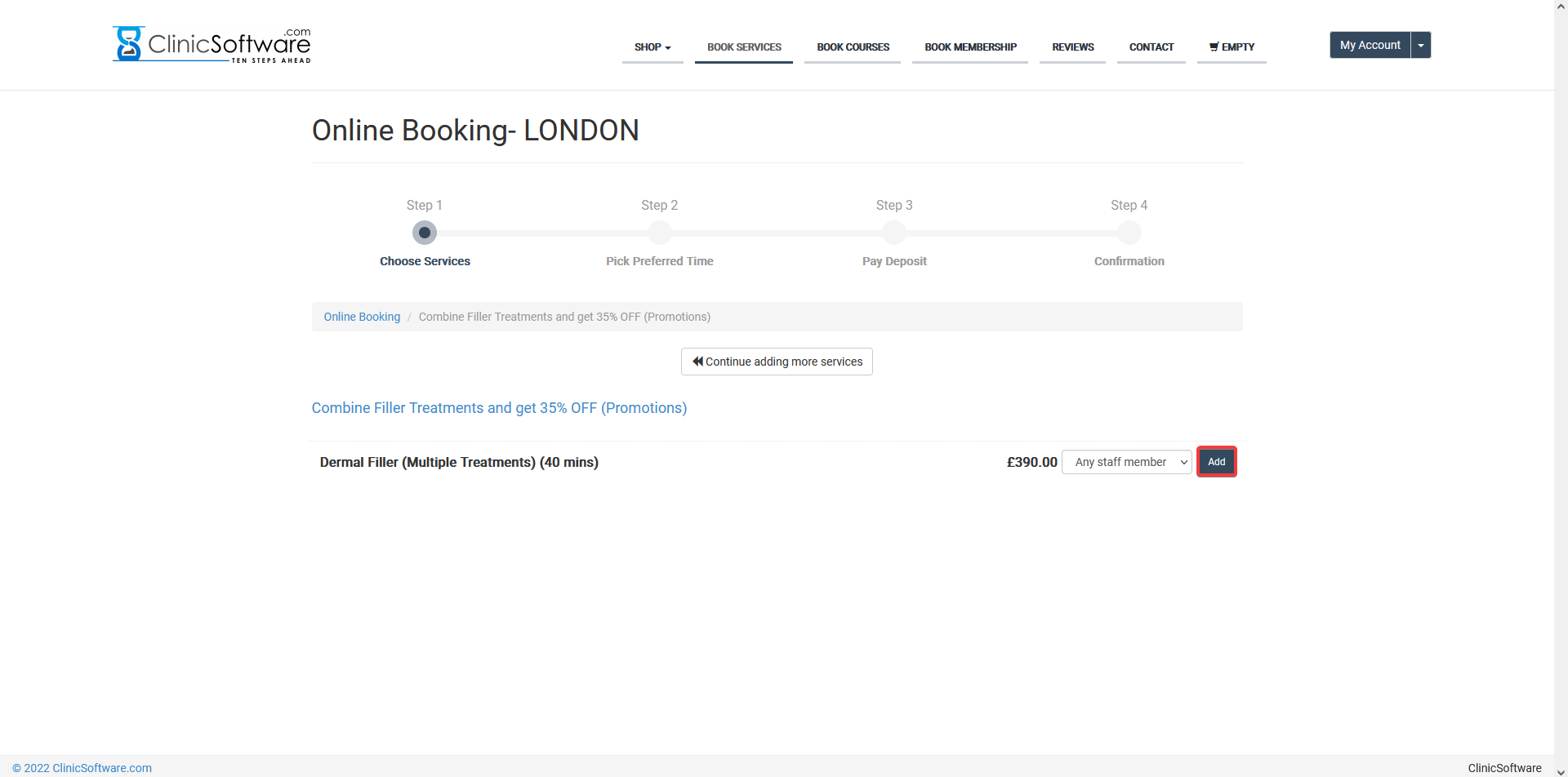

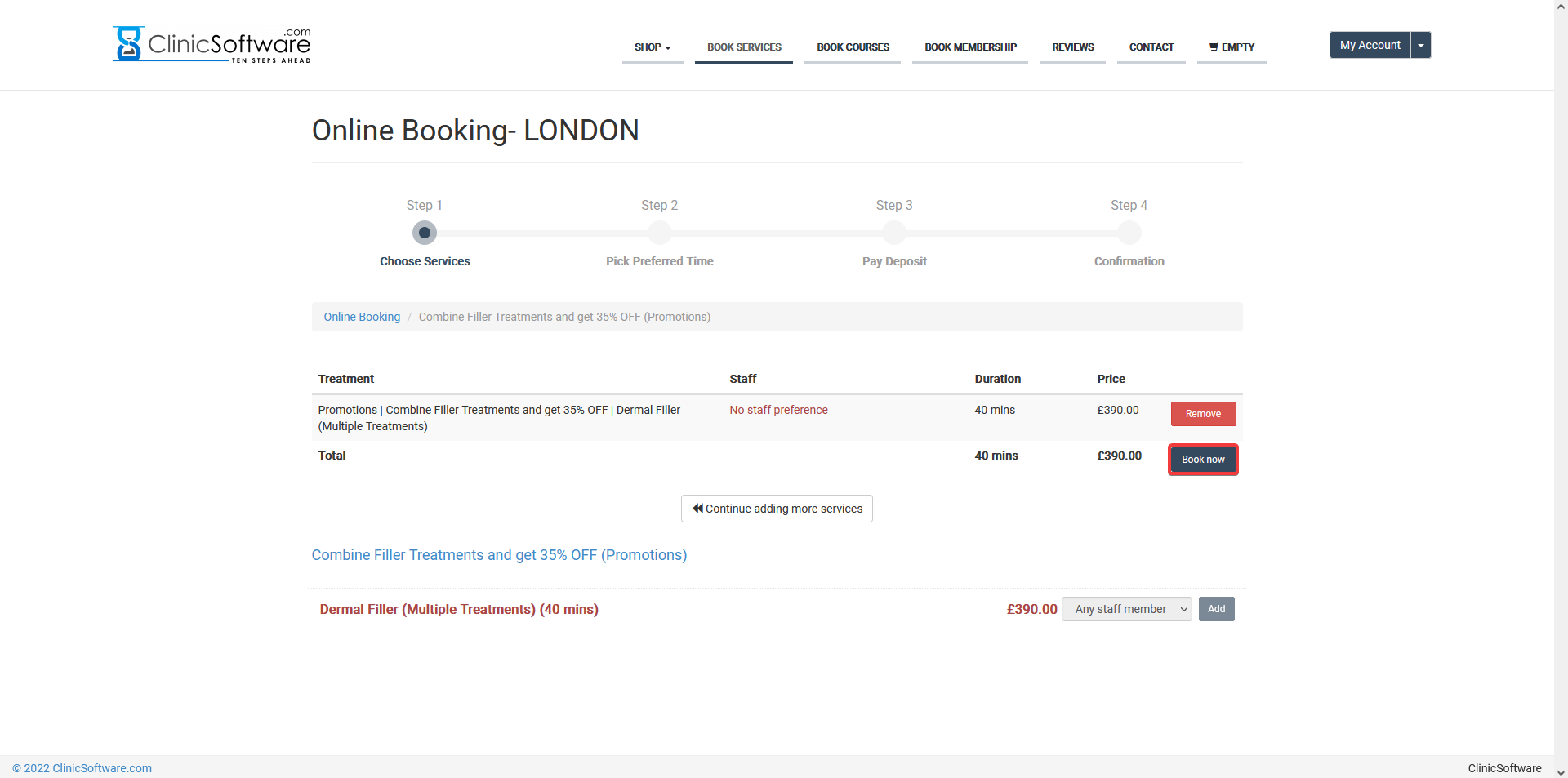

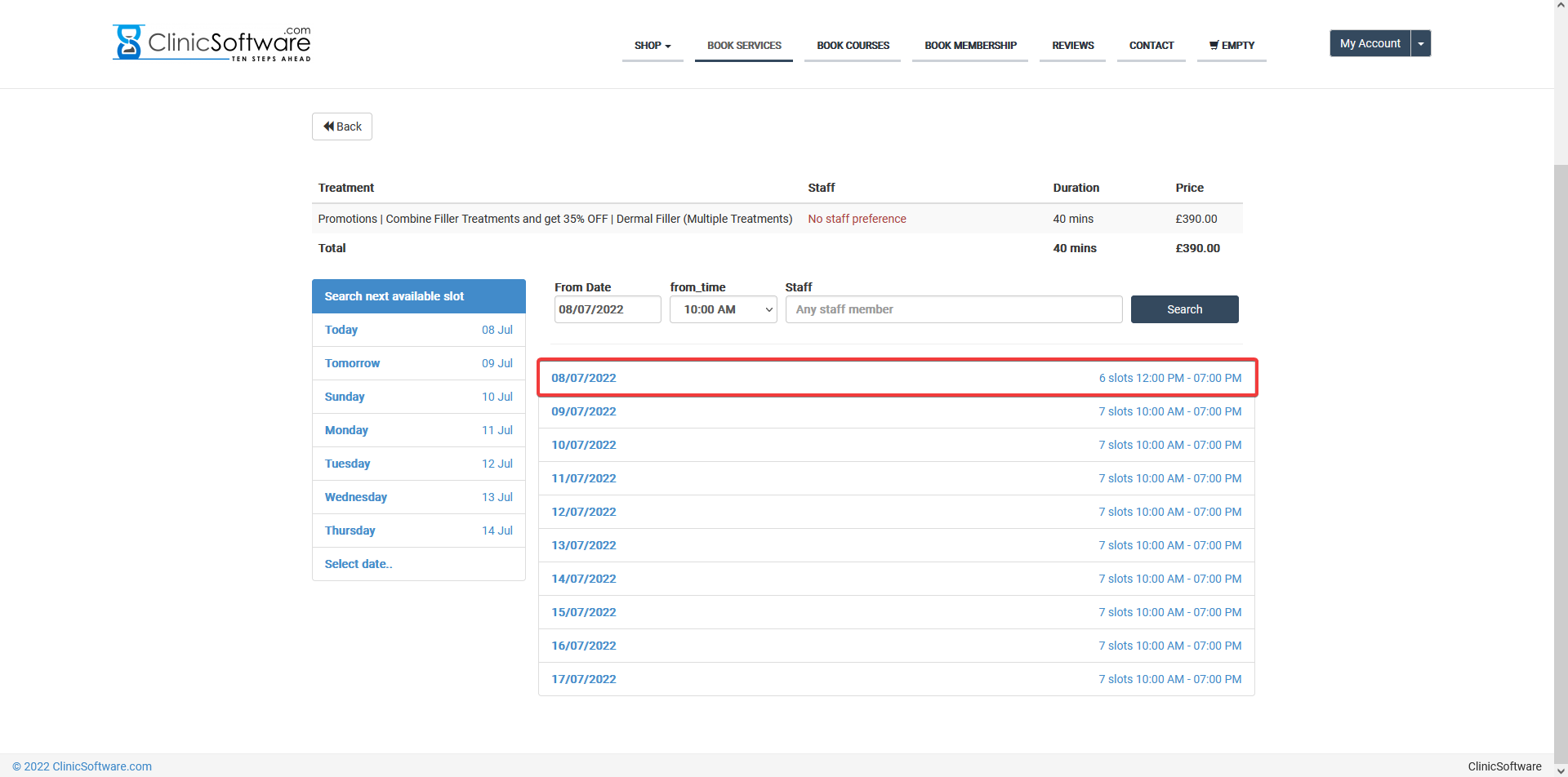

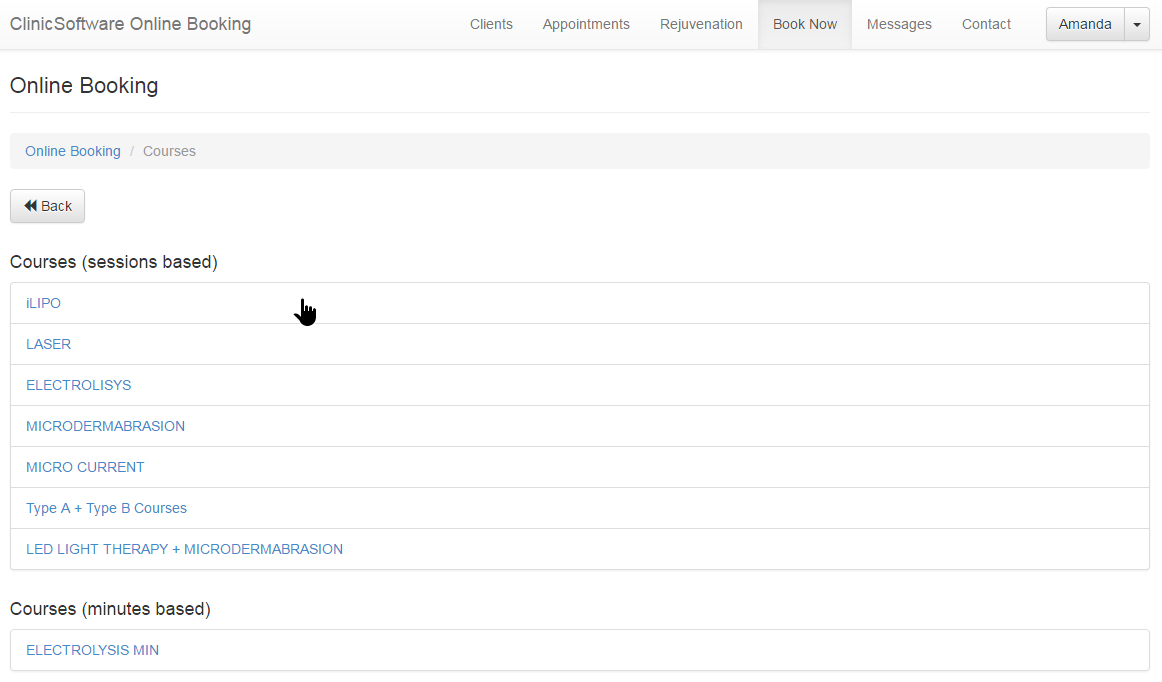

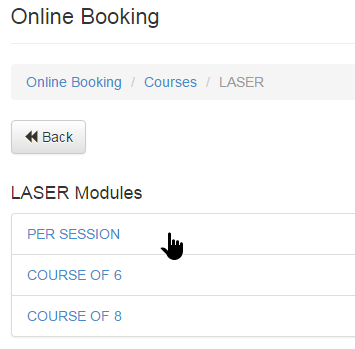

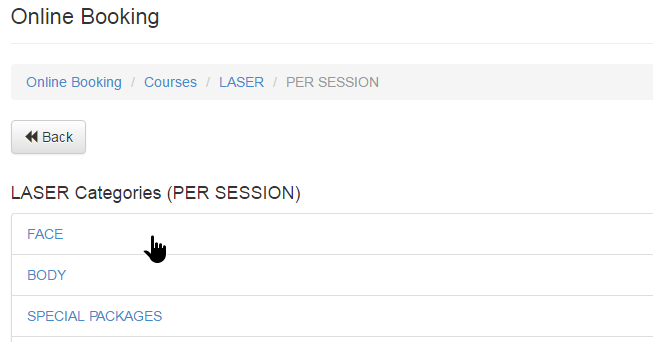

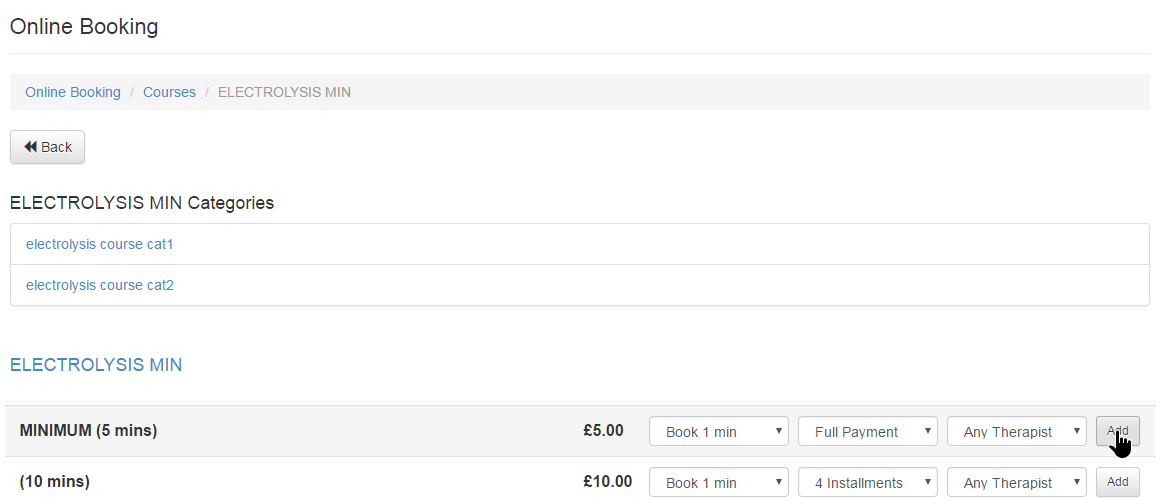

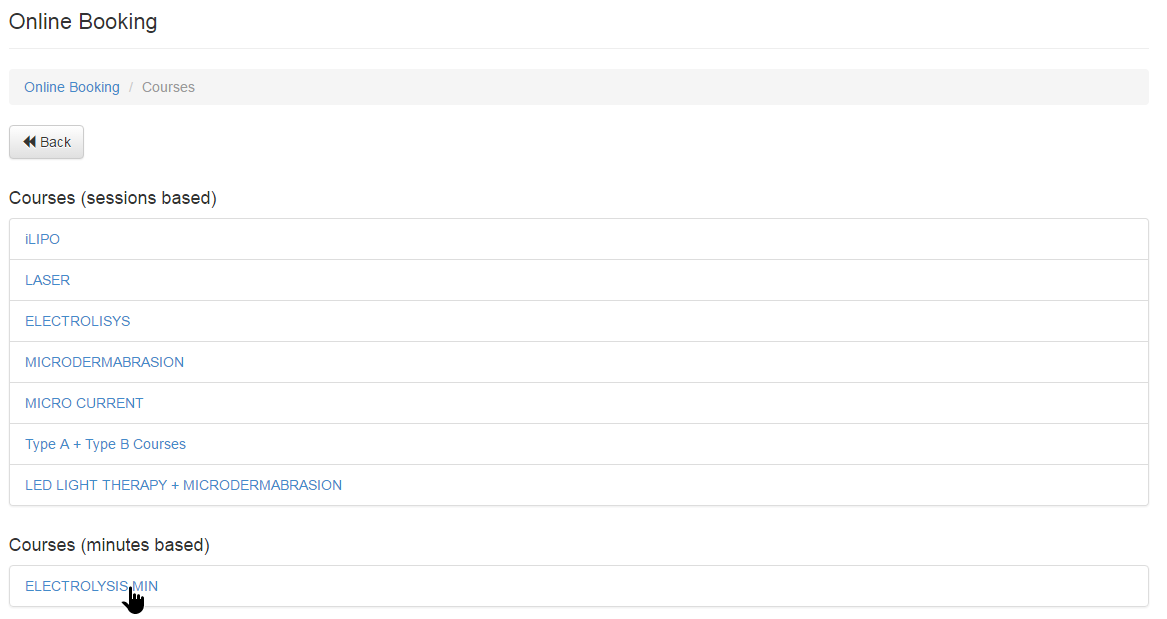

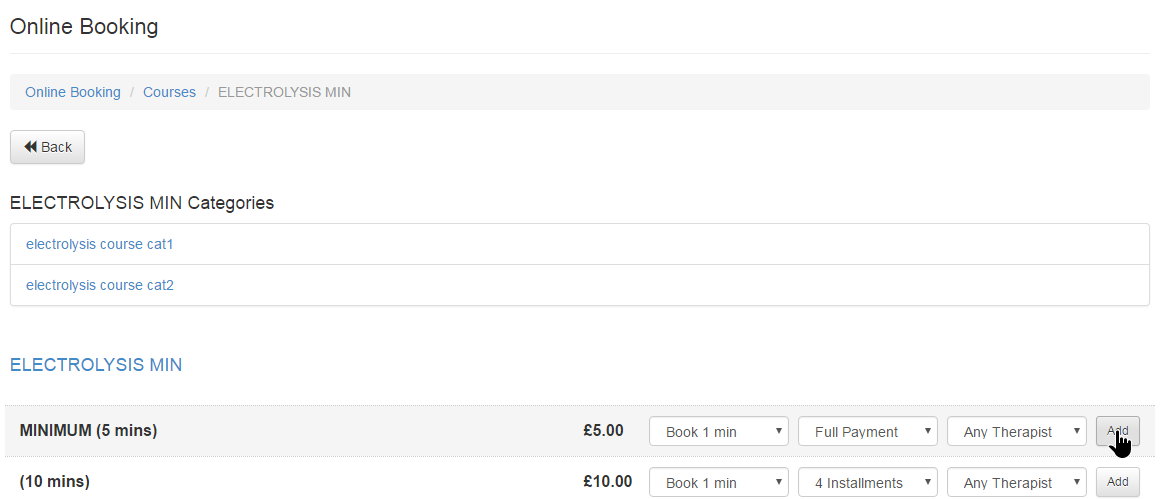

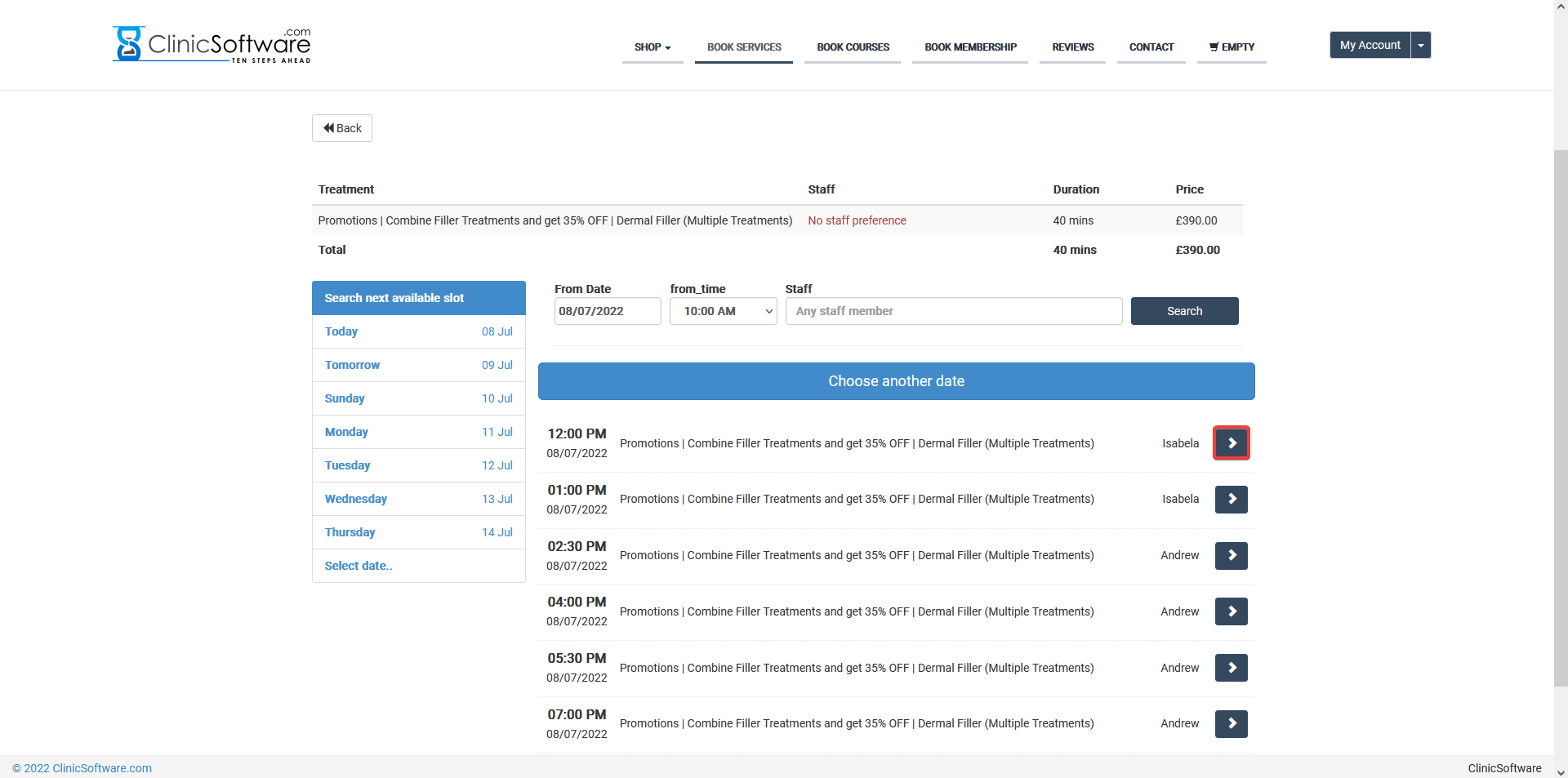

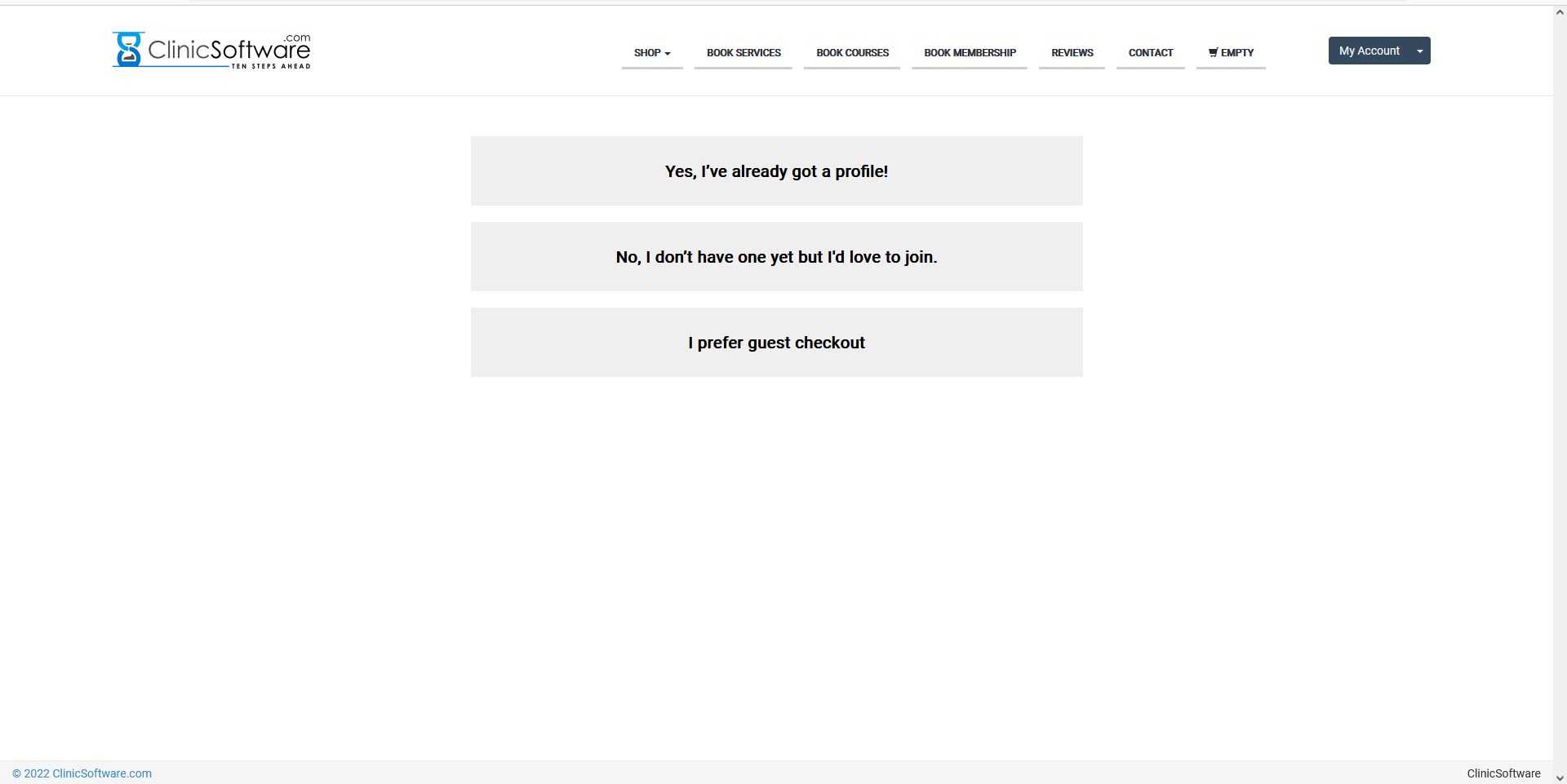

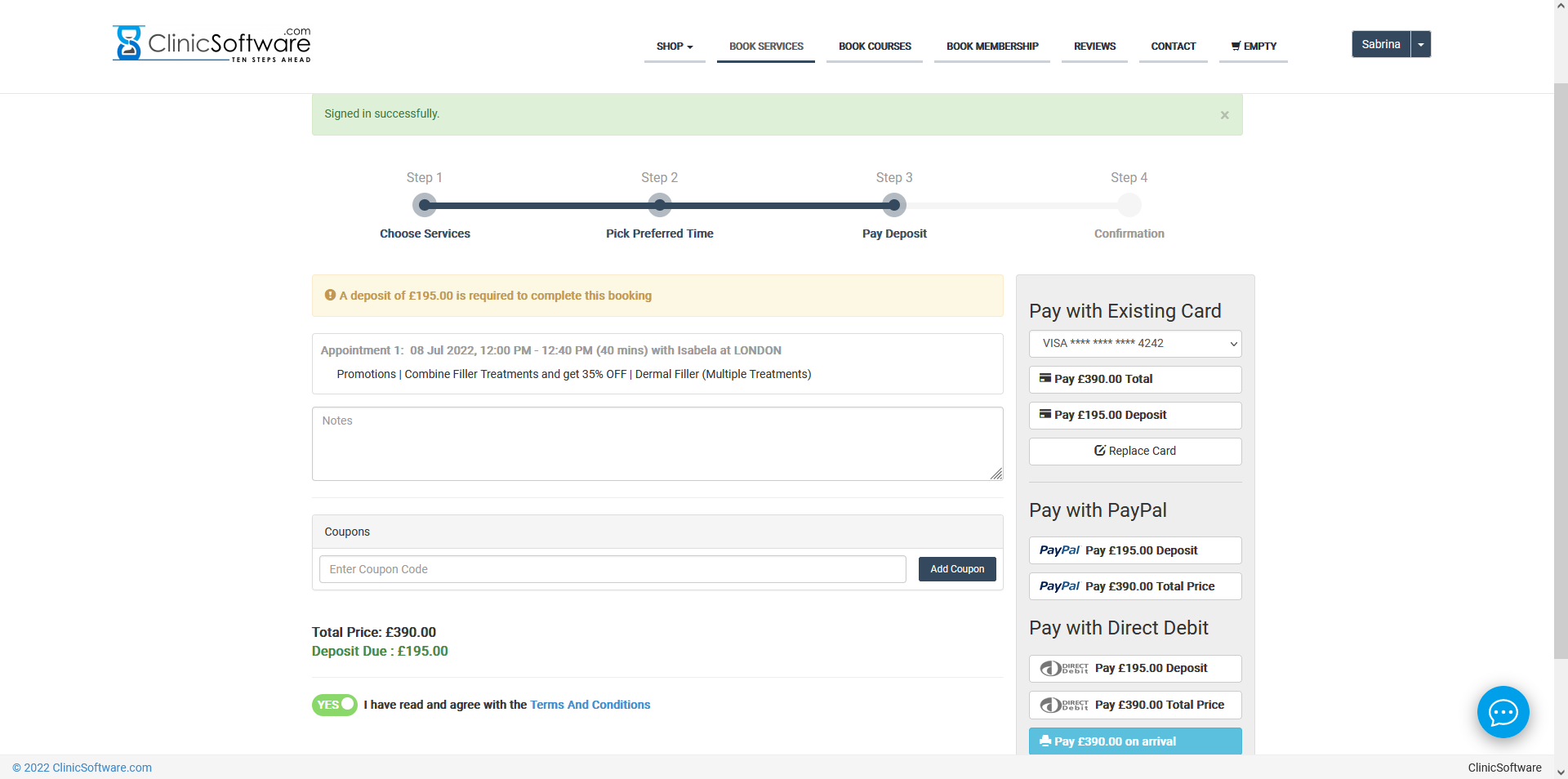

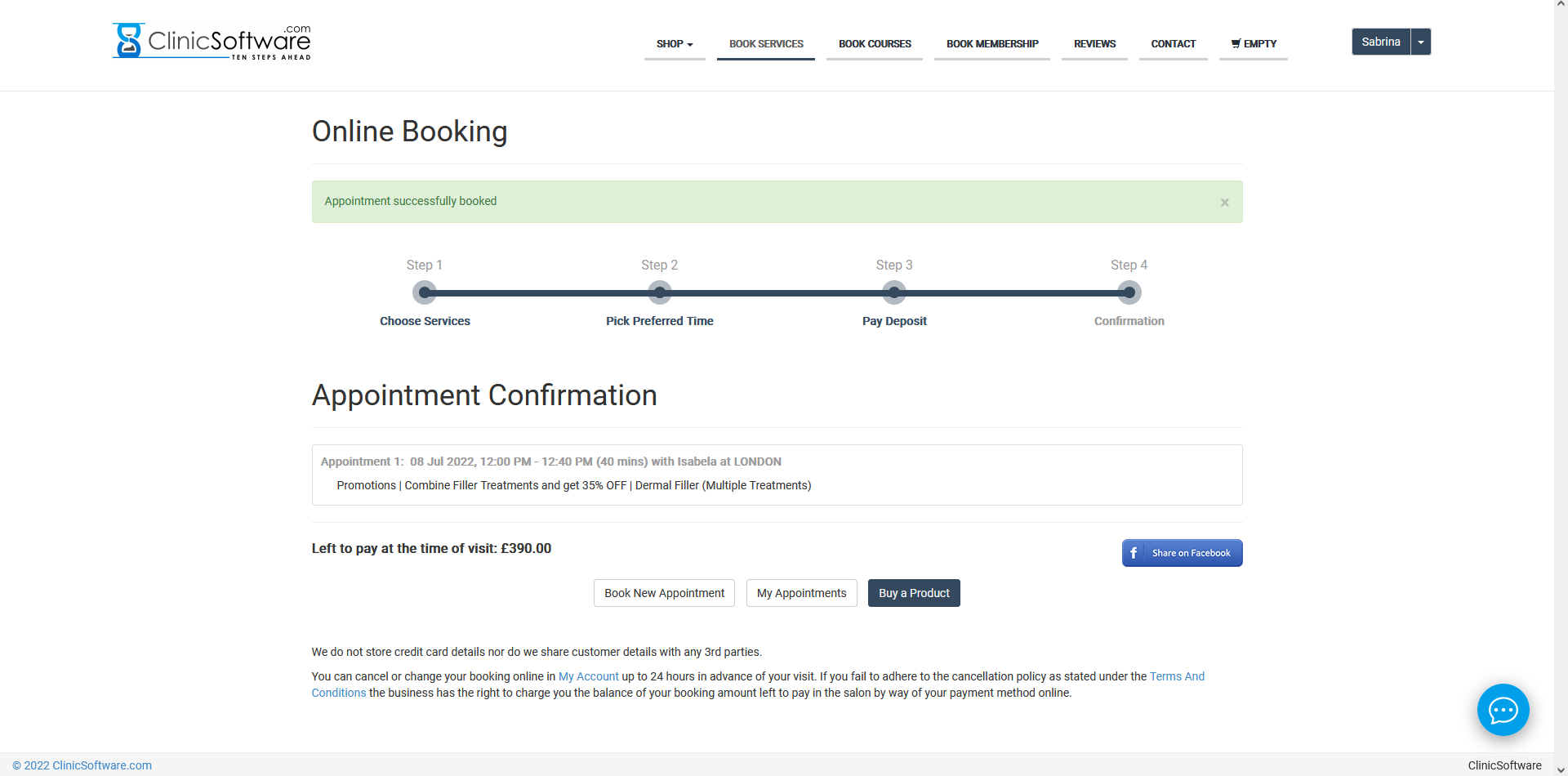

Online bookings and payments refer to a system that

allows businesses to schedule appointments and accept payments through an integrated online

platform. This feature streamlines the process for both customers and businesses, enabling

clients to book services, choose available time slots, and make payments securely from any

device, at any time. Online bookings eliminate the need for manual appointment scheduling,

while online payments simplify transactions by offering a variety of payment methods, such

as credit cards or digital wallets.

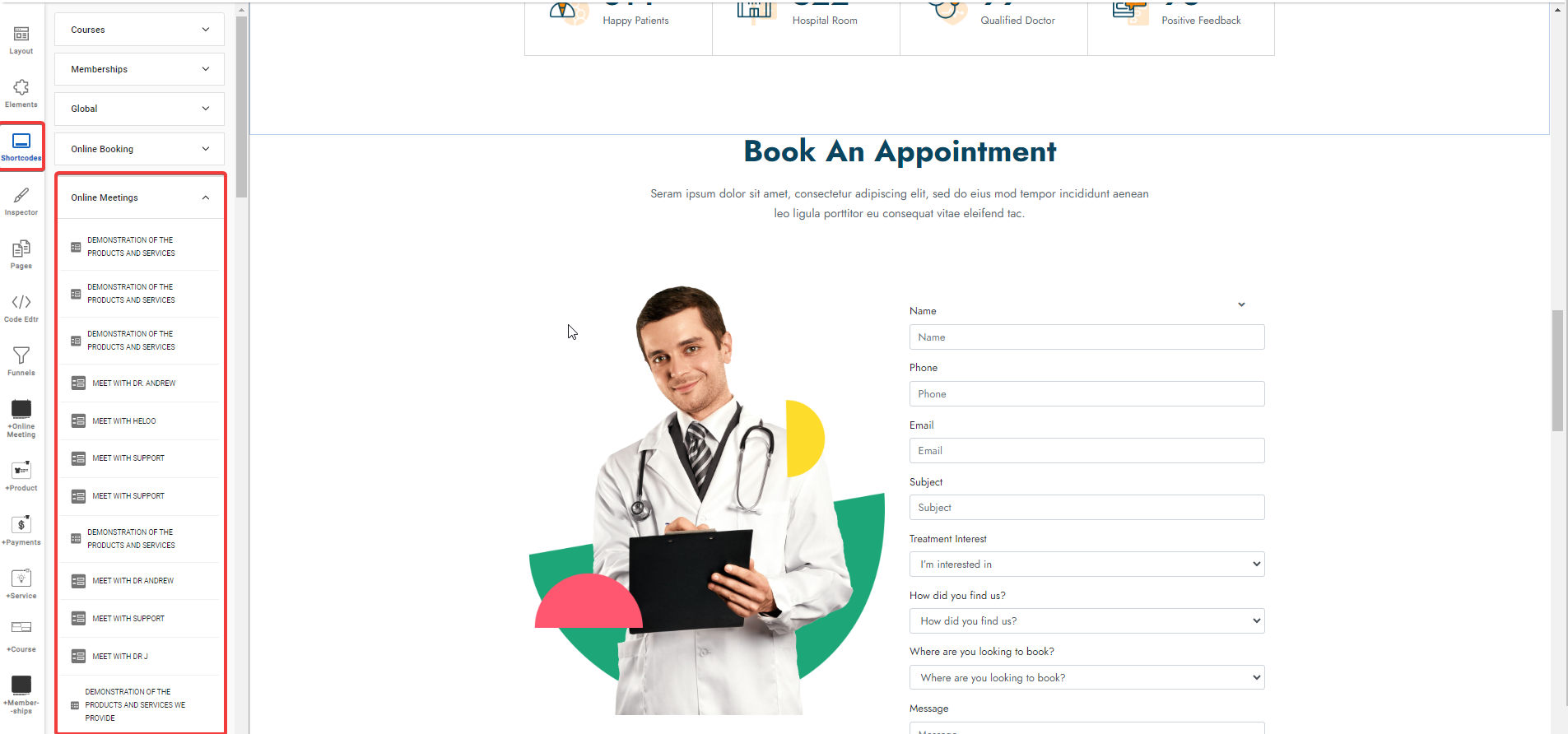

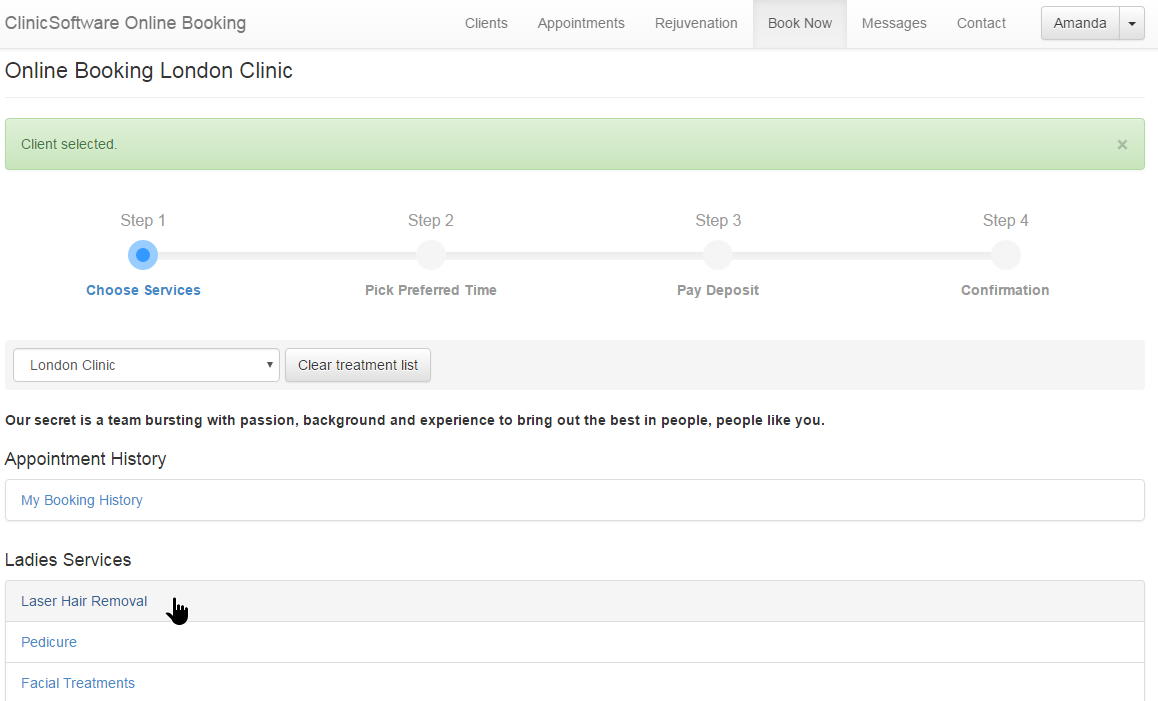

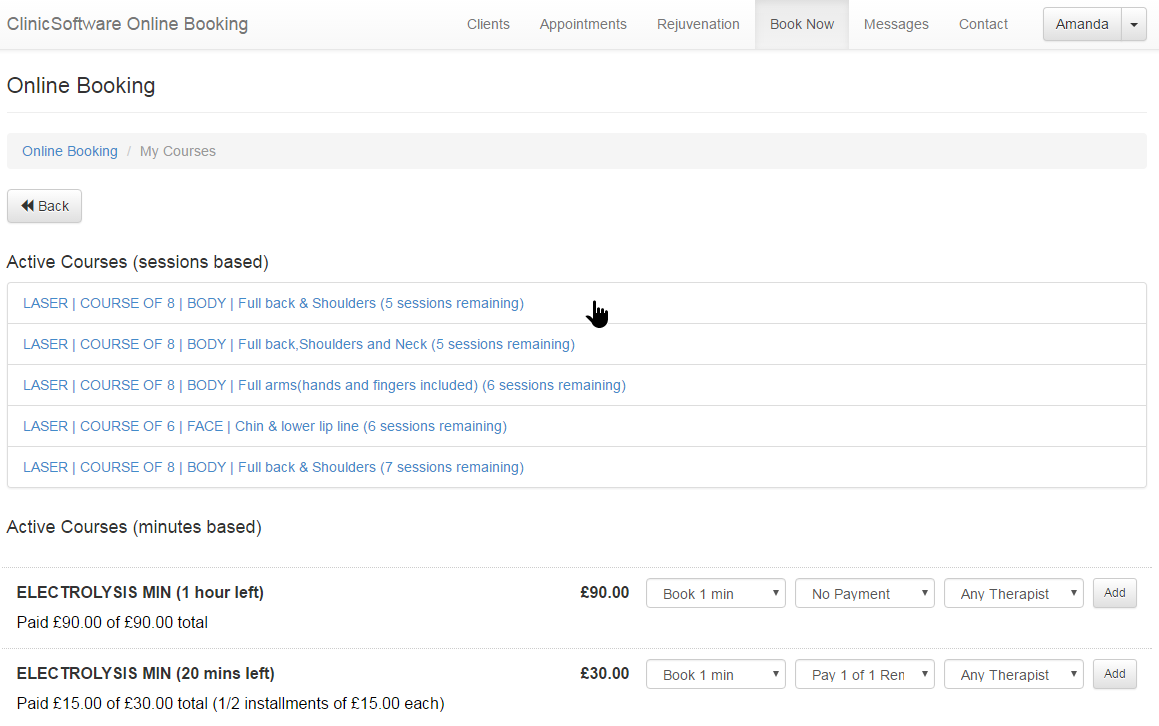

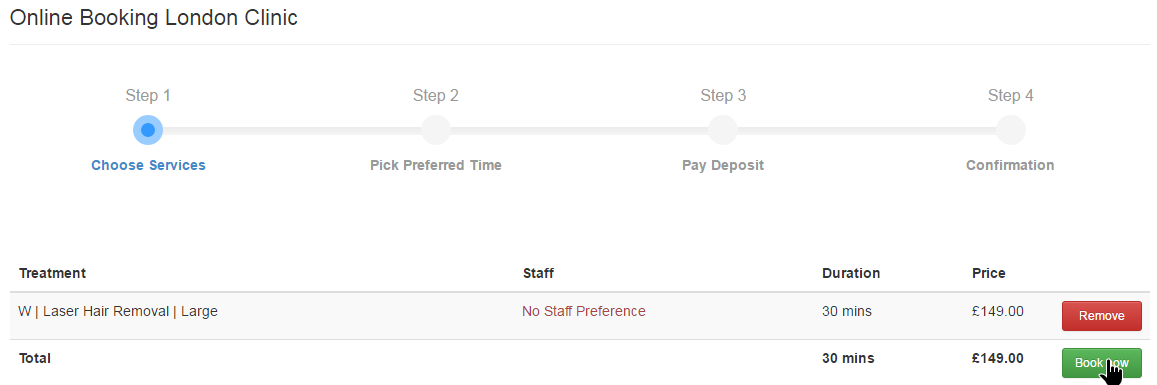

When integrated into a CRM (Customer Relationship Management) system, like

ClinicSoftware.com, online bookings and payments become even more powerful. They enable

businesses to manage customer interactions, appointments, and payments in one centralized

location. This results in a more efficient operation, improved customer experience, and

enhanced ability to track and analyze booking trends and payment histories.

Online Booking & Payments systems provide businesses with a powerful tool to streamline operations, improve customer experience, and drive efficiency. By integrating booking and payment functionality into one platform, businesses can offer clients a convenient, seamless process for scheduling appointments and making payments—all from the comfort of their own devices. For service-oriented businesses such as salons, fitness centers, consulting firms, and healthcare providers, online booking systems simplify the appointment-setting process by allowing customers to view availability, select preferred times, and confirm their bookings in real-time. This eliminates the need for back-and-forth phone calls or emails, saving both customers and staff valuable time. Adding an integrated payment feature enhances the customer experience even further. Instead of waiting to pay in person or navigating to a separate payment page, clients can make secure, instant payments as soon as they book their appointments. Many online booking and payment platforms offer multiple payment options, including credit card, debit card, and even digital wallets like PayPal or Apple Pay, making it easier for customers to complete transactions in the way that suits them best. For businesses, these systems also provide valuable insights and management tools. With real-time access to bookings and payment histories, businesses can track appointments, manage customer preferences, and reduce the risk of no-shows by sending automatic reminders to clients. Furthermore, these platforms often come with built-in analytics, helping businesses monitor trends, optimize scheduling, and make data-driven decisions to improve service offerings. Ultimately, Online Booking & Payments systems enhance both operational efficiency and customer satisfaction. By offering a simple, accessible way for clients to book services and pay securely, businesses can improve their reputation, reduce administrative tasks, and ensure a smoother, more professional experience from start to finish.

Online bookings and payments are essential features that modern businesses should adopt to enhance customer experience, streamline operations, and drive revenue. Integrated into a CRM like ClinicSoftware.com, these tools provide convenience, efficiency, and valuable insights that help businesses operate more effectively and grow their customer base.